Proven Partners for Exceptional Software Companies

2025 Recap / 2026 Outlook

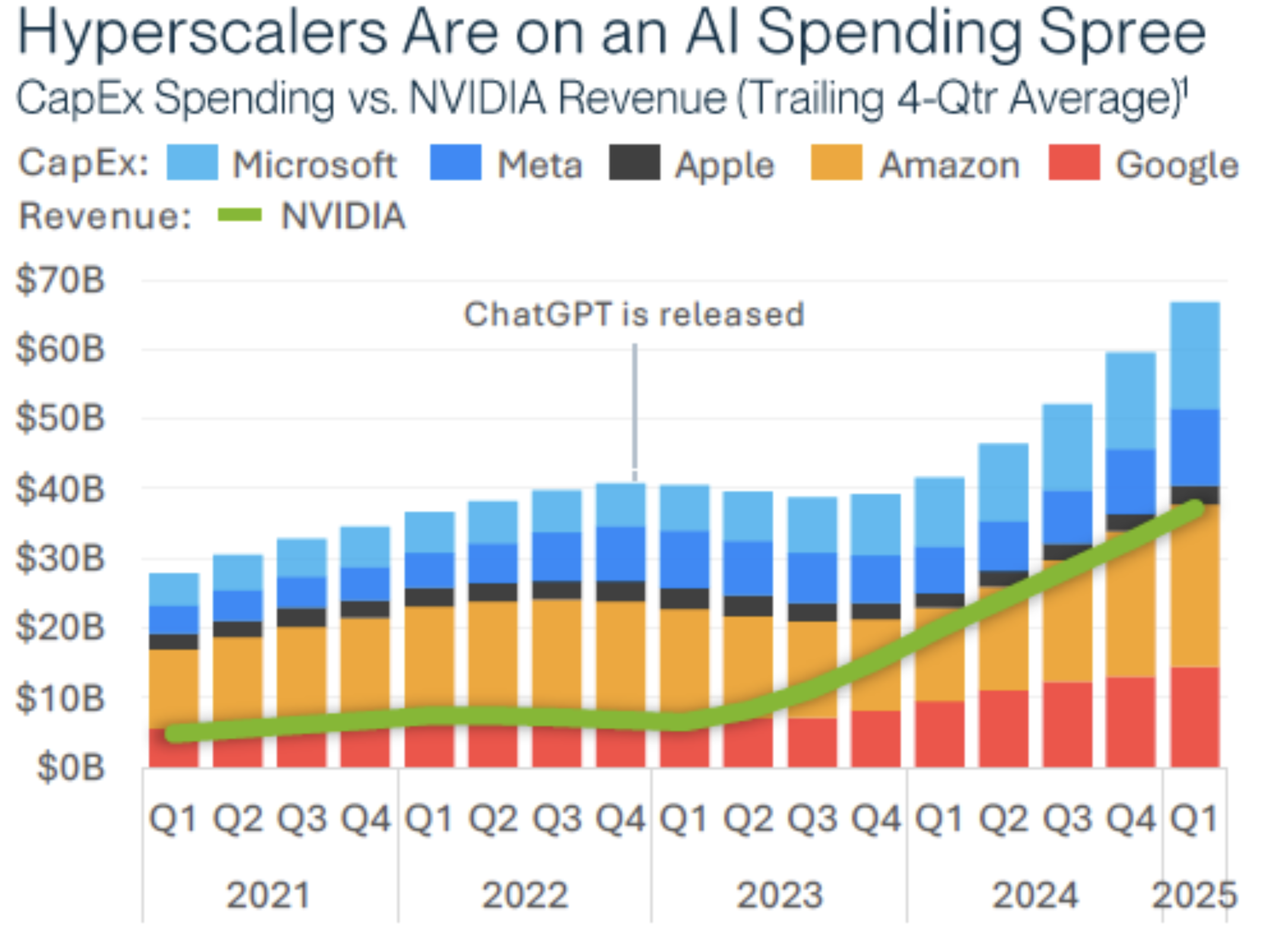

Attractive opportunities are born from an increasingly bifurcated market

2025 was a year of re-acceleration in technology, but it was not evenly distributed. Capital and attention are increasingly concentrated in a small subset of the technology industry, largely focused on AI infrastructure. We believe this unprecedented investment in infrastructure stands to produce major benefits for application-layer companies. Investment in LLMs and infrastructure is similar to the buildout of cloud infrastructure (via hyperscalers), which enabled companies to start and scale much more efficiently than ever before. Moreover, we see modern companies selling into a much larger TAM by using AI to deliver AI-enabled services that go after a greater share of their customers’ OpEx budgets.

In 2025:

~50% of global venture funding went to AI (up from 34% in 2024)(1)

In the U.S., 10 companies captured 41% of dollars (YTD through Sept. 30)

Companies are already seeing efficiency gains - startup hiring in Jan-2025 was down 17% YoY and down 62% vs. the Jan 2022 peak

Today’s investment market is barbelled: on one end are capital-intensive AI companies (compute, chips, infrastructure) that are priced to perfection. On the other end are companies poised to benefit from this infrastructure investment—growing at strong absolute rates and turning profitable earlier in their journey.

Dollars and attention are highly concentrated, leaving open an attractive opportunity

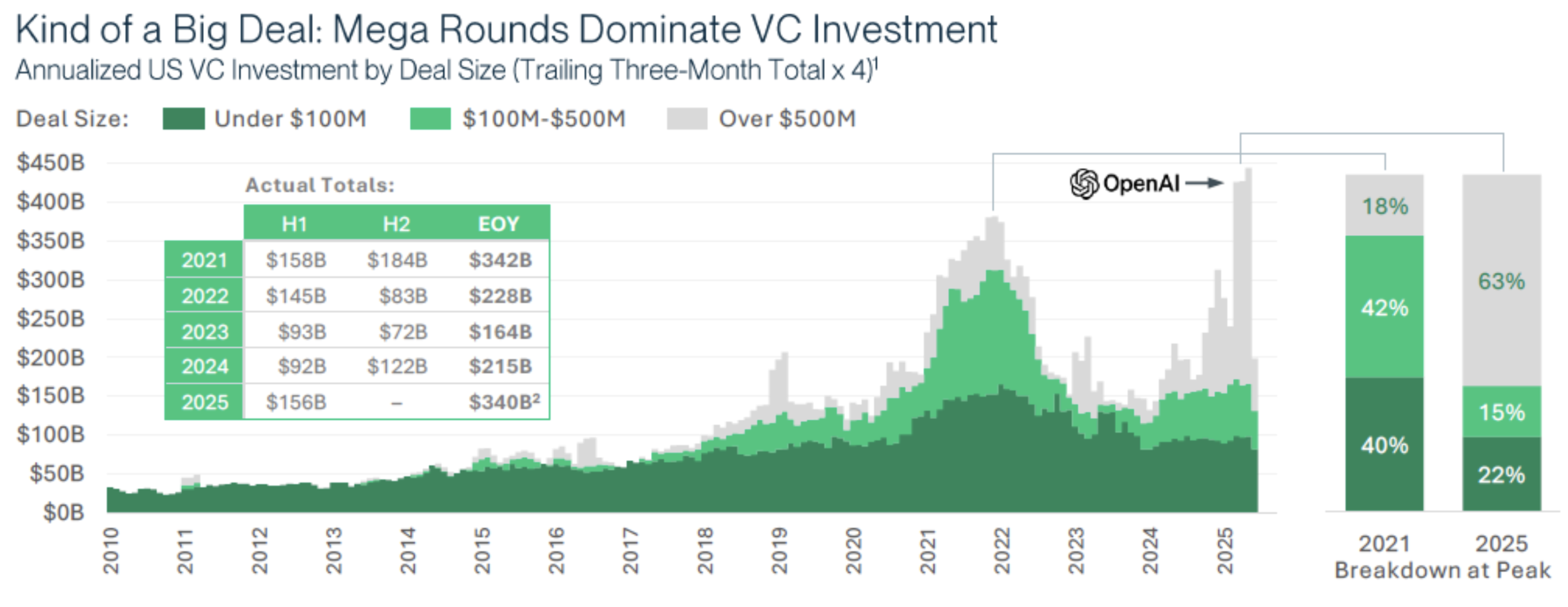

We saw extreme concentration in 2025:

$425B of global funding in 2025 went to 24,000+ companies, one-third of which went to just 68 companies.

AI alone drew $211B (up from $114B in 2024).(2)

A small number of companies are absorbing a disproportionate share of capital, especially in segments where compute, data, and distribution create structurally higher capital needs.

Fundraising concentration into large investment platforms stands to re-inforce elephant hunting. Through Q3 2025, U.S. funds raised $45.7B across 376 funds, with the top 10 funds capturing 43% of capital (highest share in a decade).

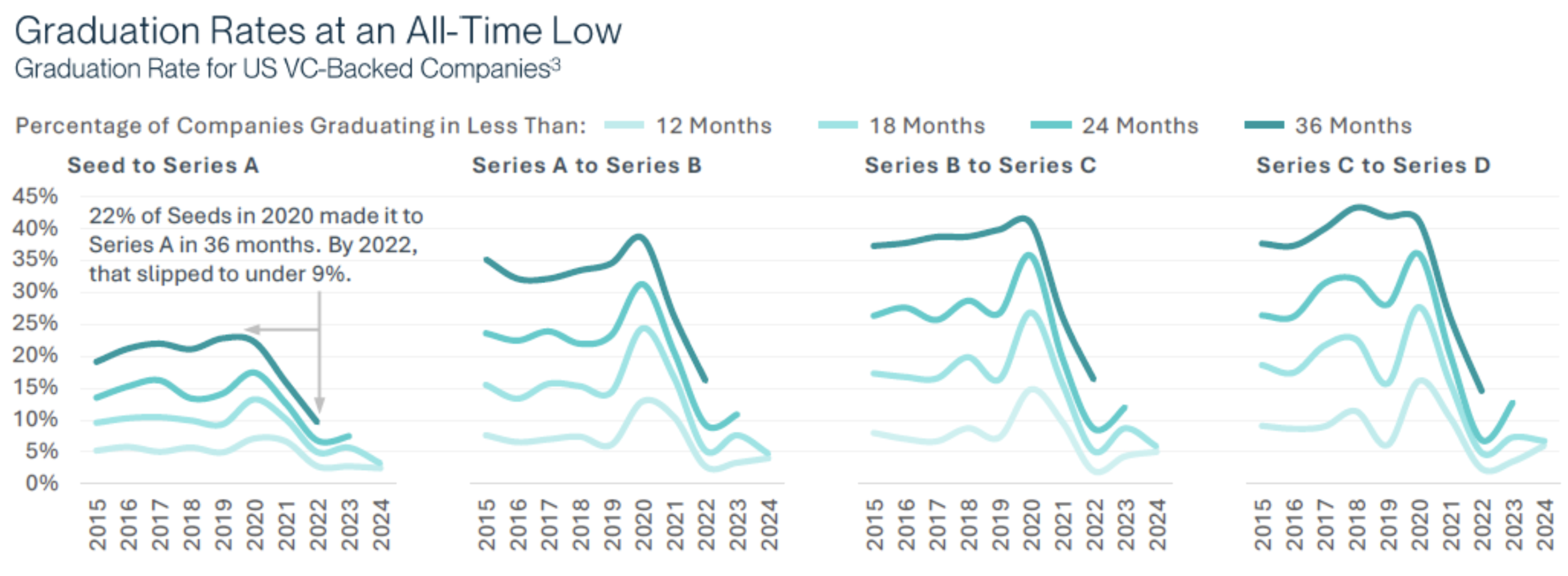

The implications of a highly concentrated environment are obvious and felt across many portfolios. The bar keeps getting higher to raise the next round of funding. As such, fewer companies are making from seed to Series A and at every stage across the funding lifecycle. While startup shutdowns have increased (Carta’s data implies VC-backed shutdowns are up ~25% y/y), we believe that many companies are opting to skip the traditional VC path. Instead, these companies are growing off profits.

Flight to efficiency

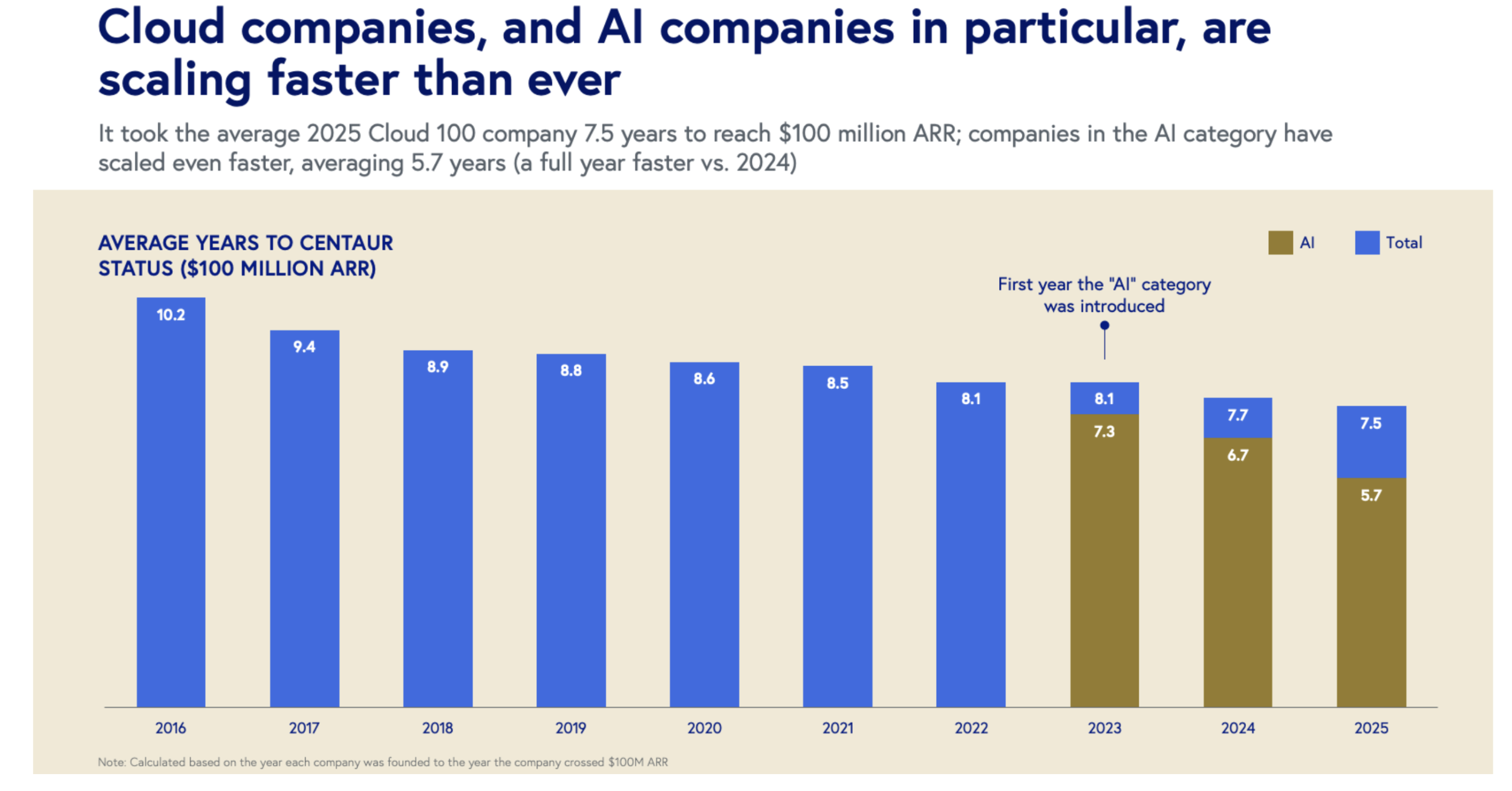

Capital scarcity has been pushing companies toward profitability for years. What’s new is that AI and continued cloud/SaaS penetration is making operating leverage more achievable without sacrificing growth. Companies are increasing the scope of what they can sell by offering AI services across their customers’ OpEx budgets. In addition, software companies are leveraging AI internally to build and distribute their products more efficiently.

Within BVP’s Cloud 100, companies saw average growth rates of 75% (vs. 55% last year). It took 7.5 years on average to reach $100M ARR down from over 10 years in 2016. AI-native companies are scaling even faster - it took just 5.7 years for AI-native companies to reach $100M ARR.

Companies are more profitable and getting further faster. Cloud 100 data suggests ~25% are already cash-flow positive, and ~94% are expected to be profitable by the end of 2025. Within earlier stage companies, SVB data shows that 2x the percentage of companies are profitable today vs. 2019.

Revenue per employee is rising: A 2025 benchmark survey from SaaS Capital (1,000+ private SaaS companies) puts median ARR per employee at ~$129,724 in 2025, up from ~$125,000 the year prior. AI Native companies are showing ARR per employee as high as $1.13M (albeit with lower gross margins).

AI exposure correlates with measurable operating leverage. PwC finds industries most exposed to AI are seeing roughly 3x higher growth in revenue per employee.

2026 is shaping up as a market where business model and operating model matter as much as product. We believe the winners will be ones that turn this AI buildout into real-world outcomes with durable unit economics. Strata’s strategy is purpose-built for capital-efficient, mission-critical vertical software where AI expands the addressable problem and accelerates the path to profitability. As the market continues to reward efficiency and optionality, we believe this is a uniquely attractive moment to back the next generation of enduring software leaders.

(1) Venture Funding according to CB Insights and Louis Lehot: https://www.cbinsights.com/research/report/venture-trends-2025, https://www.linkedin.com/posts/louislehot_ai-venturecapital-startupfunding-activity-7406749541447790592-Uxmk(2) Global Funding according to crunchbase: https://news.crunchbase.com/venture/funding-data-third-largest-year-2025