Proven Partners for Exceptional Software Companies

The Impact of AI on Tech Investing

Summary

Over the past decade, the venture capital asset class has grown dramatically. In the US alone, total venture AUM now exceeds $1 trillion, with over 3,000 active seed funds (a number that has nearly doubled since 2018). Meanwhile, growth-stage investing has shifted toward fewer but much larger deals, with some firms deploying hundreds of millions into companies as young as 12 months. These dynamics have concentrated capital at the extremes: pre-revenue companies built on promise alone, and massive growth-stage rounds on the other. The result is a “barbell” market overcrowded at both ends, leaving a compelling opportunity in the undercapitalized middle: companies with real traction but without the need for massive growth rounds.

Significant changes are underway in the world of technology investing. We explore why the most durable outcomes now emerge from companies with real traction and efficient growth.

Key insights from our deep dive:

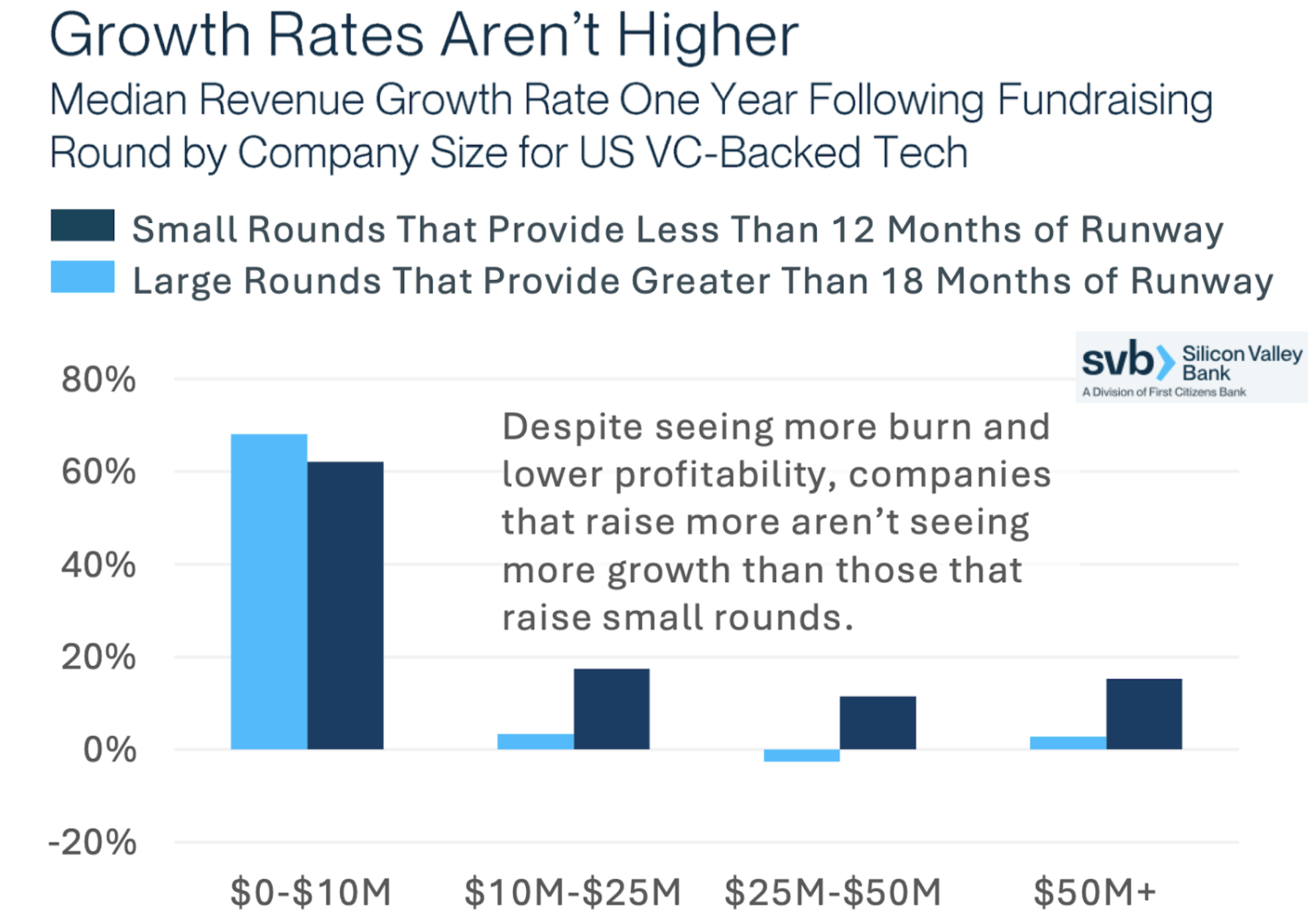

Capital excess ≠ more growth. Companies that raise more money don’t drive incremental revenue acceleration

Seed Saturation + Series A Bottleneck. Seed‑to‑A graduation plunged from 30% (2018) to 15% (2022)

AI Resets the Productivity Curve. AI‑native startups posted 100% median ARR growth in 2024 (4× traditional SaaS)

Back to First Principles. Startups anchored in core fundamentals (measured burn, real traction, and clear PMF) are outperforming bloated peers by scaling efficiently, avoiding excess dilution, and maintaining agility amid shifting capital markets

The Fallacy of More Capital = More Growth

More funding does not equate to better growth; in fact, excess capital often leads to inefficiencies and underperformance.

VCs and founders often think that higher growth necessitates higher burn. However, in every category, there are stories of businesses that grew to significant scale with very little capital and businesses that could not grow fast enough to pierce through their heavy liquidation preference. There are countless examples of capital efficient software businesses: Calendly, which grew to $70M+ in ARR, did so with a $550K seed round. Atlassian raised only $60K in seed funding and reached over $100M in ARR before raising its first major institutional round.

There is clear data to suggest that more money does not lead to faster growth. SVB’s data illustrates that when a company raises more money, it burns more. Interestingly, raising less money and burning less correlates with higher growth rates.

These larger rounds underdeliver because money creates pressure from investors to put that capital to work. Board room discussions are focused on the metrics needed to raise the next round - not what is best for long-term growth. This often leads to aggressive hiring, marketing spending, and expanding into new markets before a product has found real traction.

CB Insights data on performance after IPO is consistent with what we see at earlier stages. Companies who raised more money before their IPO tend to underperform peers that raised less.

Bill Gurley compared the current state of AI funding to a gavage tube: “what the French use to force feed the geese so that they can create foie gras…someone’s knocking on the door, trying to give them 100, 200, 300 million dollars…it forces everyone to go all or nothing.” That “all or nothing” mindset leads to hyper-scaling before fundamentals are established.

New Levels of Risk: Seed Crowding and Mega Round Overfunding

The seed stage is experiencing unprecedented crowding, soaring valuations, and a growing number of seed funds competing for deals. Simultaneously, oversized funding rounds lead to strategic misalignment and weaker long-term returns.

Seed investing is far riskier today than over the past several years driven by a low graduation rate of seed-stage companies advancing to Series A. According to Carta, 30.6% of companies that raised a seed round in Q1 2018 raised Series A within two years and only 15.4% of startups that raised a seed round in Q1 2022 could do so in the same timeframe (a 50% decline).

Active seed firms have doubled since 2018 to 3,000+ today - this surge has led to increasingly competitive, high-valuation seed rounds, placing enormous pressure on startups to deliver outsized growth early on. However, 1H 2025 saw the lowest number of Series A deals since 2012, despite a backlog of seed-stage companies. In 2024, Theory Ventures found that over the last 14 years, the ratio of Seeds to Series As had grown from about almost 1:1 to 5:1.

Hadley Harris of Eniac Ventures captured this dynamic succinctly: seed rounds are increasingly crowded, expensive, and misaligned — yet Series A bottlenecks persist.

Bill Gurley responded to Hadley’s tweet in accordance with this notion:

Oversized funding rounds in the late stage (often referred to as “mega-rounds”) are driving unsustainable growth patterns and strategic misalignment.

Gurley identified how excess capital can distort company priorities:

“Overfunding your sales force…led to revenue [but] it's not very sustainable revenue. So when you cut it back and go towards break-even, your growth rate gets hit. It would just be natural. That's what I think [leads] to low growth...Today, many of the branded firms I think have moved from maybe $500M commitment every three or four years to $5B, so 10x. And they're participating very actively in what we would call late-stage. Although I've always thought late-stage was a euphemism for big check. There are people willing to put $300M in an AI company that's 12 months old. So that's not late-stage, it's just big check.”

How AI is Reshaping Company Building and Expanding TAM

AI’s continued expansion is transforming how startups scale by reducing capital needs, accelerating product delivery, and expanding TAM.

AI lets small teams do more by operating with minimal headcount and addressing an even bigger end-market.

The impact of the internet/PCs on productivity:

Within the S&P 500, the impact of the personal computer and internet is clear. Companies went from $125K of value created per employee to $167K per employee during the PC era. In the internet era, the acceleration was even faster - growing to $335K per employee in 2024. The impact AI will have could be even larger which means that companies, of all sizes, will achieve much more with less.

Traditional SaaS primarily serves IT departments — a ~$400B market. But generative AI unlocks a $5–10T services opportunity by automating skilled labor across R&D, legal, marketing, and compliance. These platforms aren’t just tools; they redefine workflows, enhance stickiness, and capture deeper strategic value.

These platforms don’t just offer tools but instead restructure how work gets done across a value chain. This supports higher pricing power, stickier customer relationships, and broader strategic value, which were previously limited to vertical SaaS or solving specific problems.

This means three things for investors:

Lean teams, bigger markets: AI lets startups punch well above their weight

Efficient scale: AI sustains high productivity without inflating burn

Strategic breadth: AI-enabled founders are entering markets with stronger unit economics and lower risk

Back to the basics

Companies built around fundamental principles like measured burn, real traction, and clear PMF, combine the resilience of early-stage scrappiness with the traction and scalability needed for strong outcomes without the bloat of late-stage funding.

Investing in post product-market fit companies is the most attractive segment in technology investing today. Companies can get further with less capital. The scale of AUM has become a disadvantage - companies that raise more capital, don’t grow faster and have fewer options from a liquidity perspective. Conversely, capital efficient businesses can be acquired profitably, need less follow-on capital, and exhibit greater resilience to macro shifts.

Technology investing has bifurcated. Many investors have adopted spray and pray strategies - from seed through growth - and in turn shifted away from a service orientation. The barbell approach, given the evolution of company building toward greater efficiency, has left a gap in the middle: post-product-market fit companies that don’t need mega-rounds, but do need thoughtful, engaged capital partners.

This is where the most attractive opportunities now lie. AI has fundamentally reshaped what it takes to build and scale a company. Lean teams can reach larger markets faster, with lower burn and better unit economics. In this environment, capital efficiency is a structural advantage.

At Strata, we believe the future belongs to companies that scale with intention. These businesses are grounded in fundamentals like real traction, clear PMF, and measured burn while being poised to generate outsized returns without the drag of excess dilution or misaligned expectations.

References:Bill Gurley - The Gift and The Curse of Staying Private; Invest Like the Best with Patrick O’Shaughnessy: https://podcasts.apple.com/us/podcast/bill-gurley-the-gift-and-the-curse-of-staying-private/id1154105909?i=1000712224752

Silicon Valley Bank’s State of the Markets H1 2025: https://www.svb.com/trends-insights/reports/state-of-the-markets-report/