Is SaaS dead?

Why We Believe Software Is Changing and Accelerating

Software continues on a 30-year trend of becoming cheaper to build, yet a familiar question comes up again: is software dead? When open source started to gain momentum, many predicted the end of software. Why would anyone pay for tools they could procure for free?

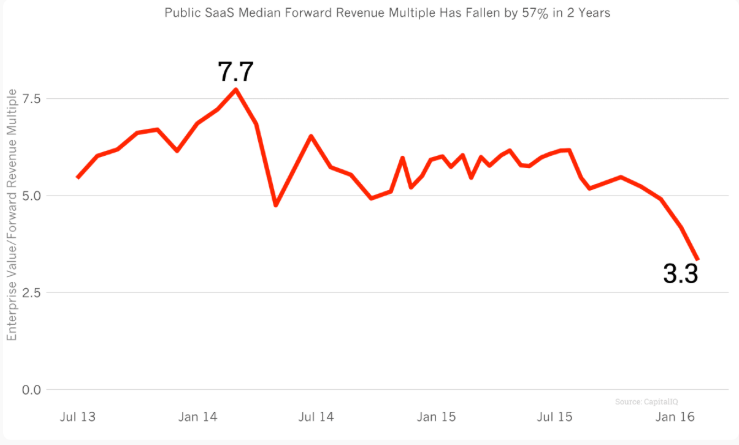

In 2016, software multiples had fallen 57% since their peak in 2014 and analysts predicted software growth was structurally challenged. The world was reaching full penetration. Salesforce dropped 13% in one day and ended that year at a market cap of $48B (vs $181B currently). The concerns around growth were overblown and over the last 10 years, the story of technology has been one consistent with market expansion. Today feels familiar. Many people point toward AI code-gen and ask: If AI can write code, who needs to buy software?

We think these concerns miss the bigger picture. AI is making software more valuable, not less. It’s compressing feature development timelines, widening the gap between “can build” and “can win,” and pushing software deeper into the operating fabric of companies. Code is getting cheaper, and it has been getting cheaper for over 30 years. However, adoption rates of technology remain high and software is now capable of automating high-cost labor, the ultimate market expansion opportunity.

Most businesses don’t wake up wanting more code. They want faster close cycles, fewer errors, better compliance, and lower labor costs. We believe that AI-enabled software is the best and cheapest vehicle to deliver those outcomes. Our view is simple: software isn’t dead. The bar is just higher. The winners will be the companies that pair AI with deep workflows, distribution, trust, and a service orientation while staying capital efficient.

A key shift: from vertical software to verticalized software

For the last decade, vertical software meant purpose-built workflows for a specific industry. We believe the next era is verticalized software: software that doesn’t just record the work, but increasingly does the work.

Verticalized software starts as the system-of-record and expands into the services around it: the manual processes, labor, and outsourced services that live upstream and downstream of the record. This is where much of the budget and pain lives today. As an example: instead of using an Electronic Health Record (EHR) and outsourcing Revenue Cycle Management (RCM) or integrating third party tools for transcription, all of this functionality can live on top of the EHR and be fully integrated into your existing workflow. Customers often pay more for these services than what they spend on the system-of-record. By verticalizing the platform, a software vendor can quickly increase account value and offer a more deeply integrated solution to benefit the customer / end-user.

We are already seeing the risks of not owning the record and the inherent advantage some vendors may have. Last year, Slack / Salesforce blocked API access to their data in favor of their own tools. Recently, Epic (EHR) sold its stake in Abridge (AI scribe) and launched a competing transcription product that is directly integrated into the EHR.

Incumbents vs. New Entrants: AI Changes the Game for Both

AI is changing the shape of competition. Feature development is accelerating, and the distance between an idea and working demo is shrinking. This is where the narrative goes off the rails.

In software, the hardest part has never been writing the first version of the product. The hardest part is everything that comes after; building distribution, integrating with third party applications, earning trust with customers, maintaining uptime, and supporting security / compliance requirements.

That’s why incumbents remain durable when they are the system-of-record. The more embedded the product is, the more it becomes infrastructure. At the same time, AI creates legitimate openings for new entrants. When incumbents are weak in specific modules or where companies can bundle software with AI-driven services and deliver far cheaper/better outcomes, AI disruptors may have an edge.

One example is Sierra (AI-driven customer support), which has scaled quickly by reducing labor costs while delivering high ROI to customers. Sierra takes an agent-centric approach that spans every customer communication channel, building a unified, full-view of the customer. That proprietary context allows its agent to make higher-quality decisions than a traditional human workflow constrained to a single inbox, queue, or tool.

A second threat to horizontal incumbents is a vertical software provider leveraging its embedded data and customer relationships to offer the same functionality. For example, Toast could deliver AI-driven customer support on top of its ordering and POS platform, advantaged by the merchant / diner data and workflow position it already owns.

While Sierra is still early, this approach highlights a credible path for AI-native companies to wedge into adjacent workflows and expand toward the system-of-record over time. Ultimately, we believe defensibility is increasingly earned through a combination of proprietary data, switching costs, workflow ownership, distribution, and service regardless of whether the winner starts as an incumbent or a new entrant.

We believe a big risk to incumbents is their pricing model. In a world where companies need fewer people, pricing based on seats no longer makes sense. Successful companies will need to shift towards pricing for outcomes. In the Sierra example, there is a classic innovator’s dilemma: pricing based on seats for customer service agents creates misalignment between the vendor and customer. If automation can result in fewer seats, the customer should pay less. This challenge is similar to the challenge perpetual license companies faced in the shift to SaaS. Companies that were able to adapt thrived by leaning into their distribution advantage.

Will Companies DIY? Prototypes Are Easy. Production Is Not.

The concern we hear most often: “If AI makes it easier to build software, won’t companies just build what they need?”

Sometimes they will especially for narrow internal tools, lightweight workflows, or department-level automation. AI lowers the cost of experimentation and we expect more companies to tinker with ways of automating tasks using AI. However, the DIY argument breaks down quickly when you move from a narrow tool to a system.

Production-grade software requires:

security and access control

uptime and monitoring

data governance

integrations and API maintenance

testing, edge cases, and version control

ongoing product iteration

support and training

This is not a one-time build. It’s a permanent commitment. Ultimately, DIY software shifts the cost from procurement to maintenance and increases the risk of instability and security issues. This is why “buy vs. build” has been a durable trend for decades even as software development became cheaper. When a vendor can amortize R&D, compliance, and integrations across thousands of customers, the buyer gets leverage they can’t replicate in-house.

For customers, AI makes it easier to prototype but it doesn’t eliminate the need to maintain software. On the other hand, the companies we invest in are using AI to bring down their development costs by 20-30% which is enabling these companies to move faster and generate more cash-flow. We believe that companies of the future may be able to add 10-30 points to their bottom line. If that future materializes, today’s multiples may appear quite cheap in hindsight.

The Next Era: From System-of-Record to System-of-Action

One of the shifts we’re underwriting is that software is becoming more service-like. Historically, many SaaS tools were sold as configurable products. The customer had to learn the product, implement it, and stitch together surrounding workflows.

AI flips this. The best products increasingly behave like an expert embedded in the workflow and a layer of automation that reduces labor, not just clicks. Verticalized software is the natural extension of this trend. Once a company owns the system-of-record, it’s in the best position to automate work and turn services spend into software margin.

This matters because it changes both value creation and pricing power. If you help a customer reduce manual work, eliminate errors, accelerate cash collection, or reduce compliance burden, you can price against the value created, not just against what a tool should cost.

This is also why we believe the concerns around commoditization of software are wrong. Some companies who struggle to create value outside of workflow or are heavily indexed to per-seat pricing will find themselves in a tough spot. However, by enabling companies to price against value created or outcomes, software will be able to dramatically increase pricing and account value.

How these dynamics shape our investing strategy at Strata

We believe that code has never made software defensible. The “AI makes prototyping easier” narrative is real, but it changes where durable advantage lives. In our view, the best opportunities sit where software can: (1) become deeply embedded as a system-of-record, and (2) verticalize into the services and labor surrounding that record.

Practically, that pushes us toward a few consistent underwriting choices:

We prioritize system-of-record businesses or ones that can use a wedge to expand to record. We like companies that have proprietary data and the ability to build network effects at scale.

We look for verticalized expansion. Our goal is to capture more of the customer’s services and labor spend by closing the loop (execution, verification, compliance, payment, etc.) and pricing against outcomes. This is how ACV expands even as seat-based pricing comes under pressure.

Our diligence emphasizes (a) distribution and implementation motion, (b) integration depth and data access (including platform dependence risk), (c) compliance/security posture in regulated workflows, and (d) evidence of measurable ROI that supports outcome or usage-based pricing.

We avoid horizontal software and thin UI layers. We get cautious when the primary value prop is UI convenience, when the product is easy to swap, or when pricing is tightly coupled to seat counts. Rather than look for horizontal software, we believe that often a vertical approach provides a better customer experience.

We are CapEx light and agnostic of model providers. We believe the best AI-enabled companies will leverage multiple models and that it doesn’t make sense to compete head-to-head by building your own infrastructure. Relatedly, we view LLM providers much like cloud providers. We believe these LLM providers will provide powerful infrastructure to build upon but we don’t see them as direct competitors in vertical applications.

Looking Ahead

AI reduces the cost of creating features. It increases the premium on everything else: workflow ownership, trust, integration, distribution, and measurable ROI.

Software isn’t dead. The era of thin products that win on features alone might be. The next decade belongs to companies that pair AI with deep domain understanding and deliver outcomes customers can’t live without and increasingly, to verticalized platforms that expand from systems-of-record into the services surrounding them.